A very shocking incident came to light recently with multiple employees of eKart (Delivery wing of Flipkart) vendor Creativity at Best Technology (CABT) in Mirik

The data, it turns out was used by their employer eKart Vendor CABT to take out loan without informing the victims.

We are fearful that what happened in Mirik is just the tip of the iceberg, and there is every possibility that the company’s extent of financial misappropriation, if it can be called that, or straight out financial fraud, may in fact be far wider. Involvement of App-based loan companies KarmaLife and InnoFin in this whole murky business exposes the dirty underbelly of FinTech start-ups, that may be duping thousands of victims, without their knowledge even.

The Mirik eKart Case

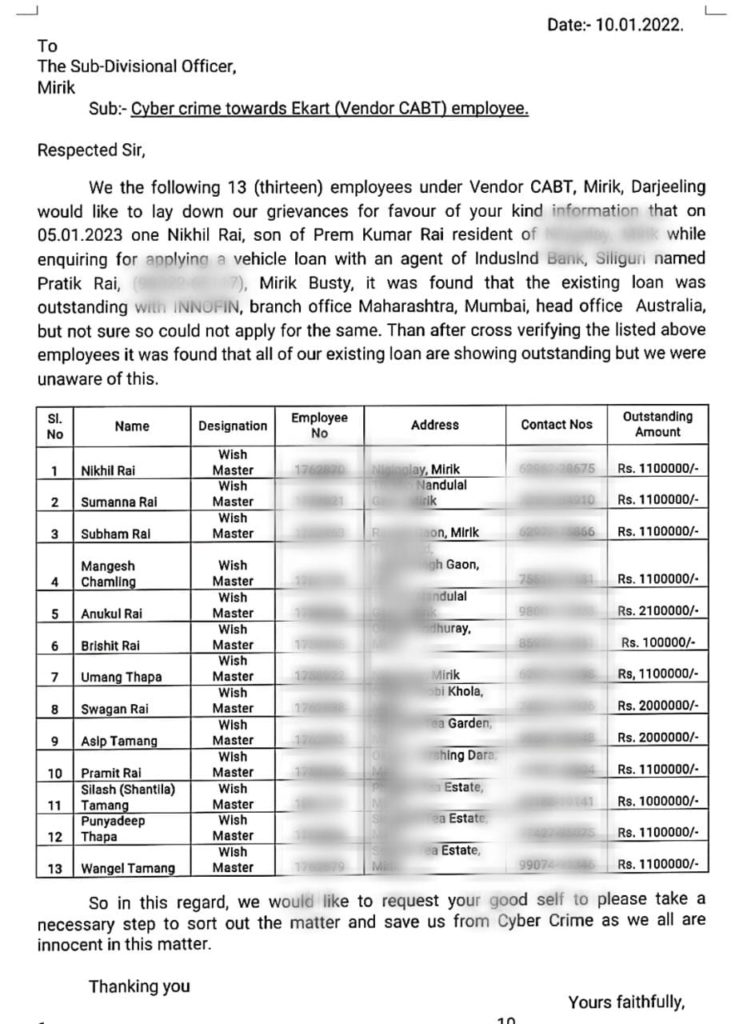

The story began to unravel on the 5th of January, 2023 when Nikhil Rai, a 19-year-old “wishmater” (a term used for the delivery executives of eKart) decided to get a loan sanctioned by some bank. He wanted to buy a car, as he was needed to travel often. Surprisingly the bank denied him loan, as he had a very low CIBIL Score.

Shocked, he sought details, that is when the Bank Staff explained to him that on proceeding with the preliminary formalities, the bank staff checked his CIBIL score – which is a measure of an individual’s credit health. The score ranges from 300-900 and higher the score, higher is the chances of you getting your loan approved. Nikhil’s score was low.

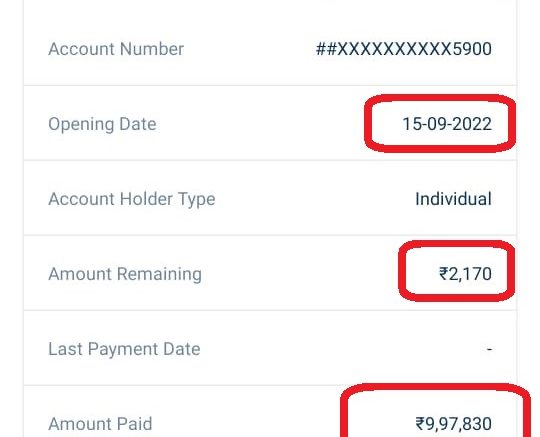

Surprised further, Nikhil inquired as to why that would be the case, as he had never taken out any credit. That is when the Bank Staff informed him that according to the records available with Credit Score rating agencies, he already had an outstanding loan of Rs 11 Lakhs on him. When Nikhil insisted that he had never taken any loan ever, the bank staff thought that it might be a technical glitch and made another check, but the result didn’t change.

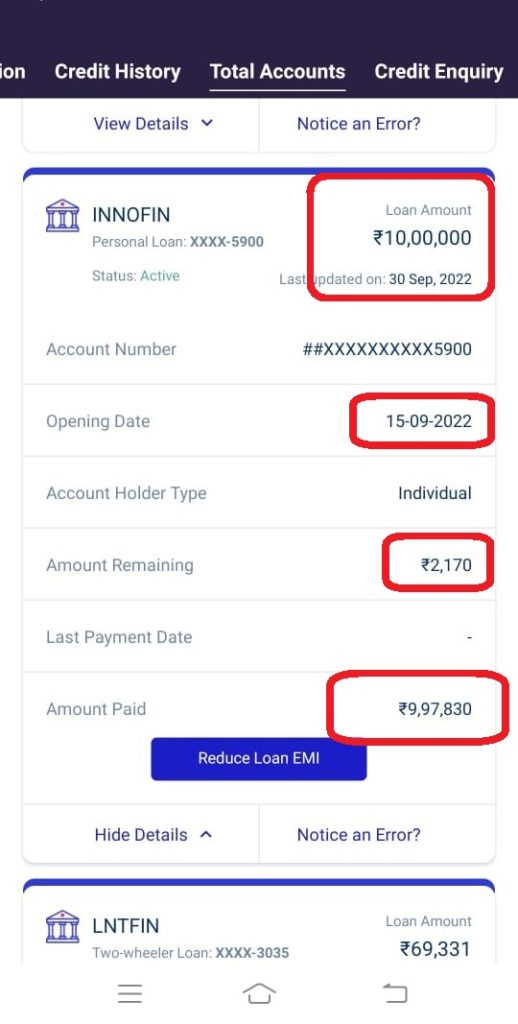

Nikhil was still very sure that it would be a technical glitch, as would any other 19-year-old guy be on hearing the same. He then called on his friend and colleague to check his CIBIL once. Surprisingly, the friend had the same amount of loan amount reflecting on his CIBIL report too. It was slowly discovered that all of the 13 delivery executives or ‘wishmasters’ of eKart working in the Mirik Branch had loans withdrawn against their names with the amount ranging from Rs 1 lakh to Rs 21 lakhs and averaging around Rs 10 lakhs.

What is interesting is that some of these loans were being repaid by some third party, also outside the knowledge of the employees.

Few important points to note here:

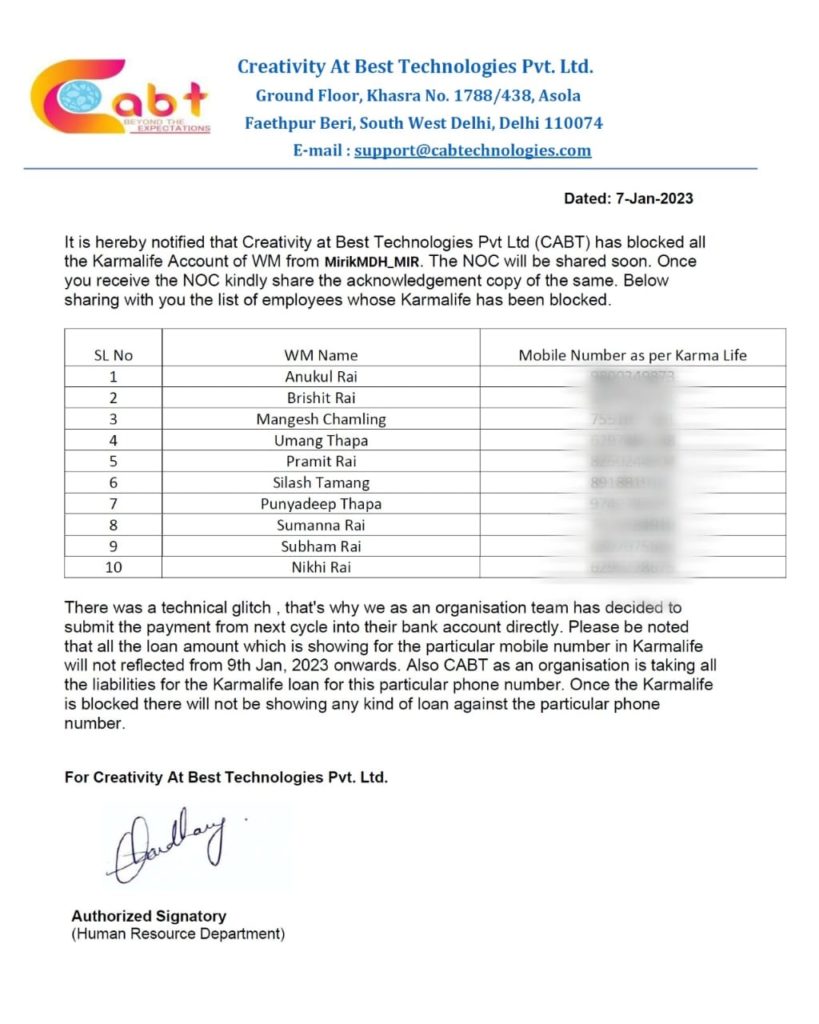

- eKart is the delivery wing of e-commerce giant Flipkart, that delivers products for the online shopping platform. But however, eKart is not directly operated by Flipkart, but it is done through a vendor – in this case a company named Creativity at Best Technology (CABT). So the victims were the employees of CABT Logistics.

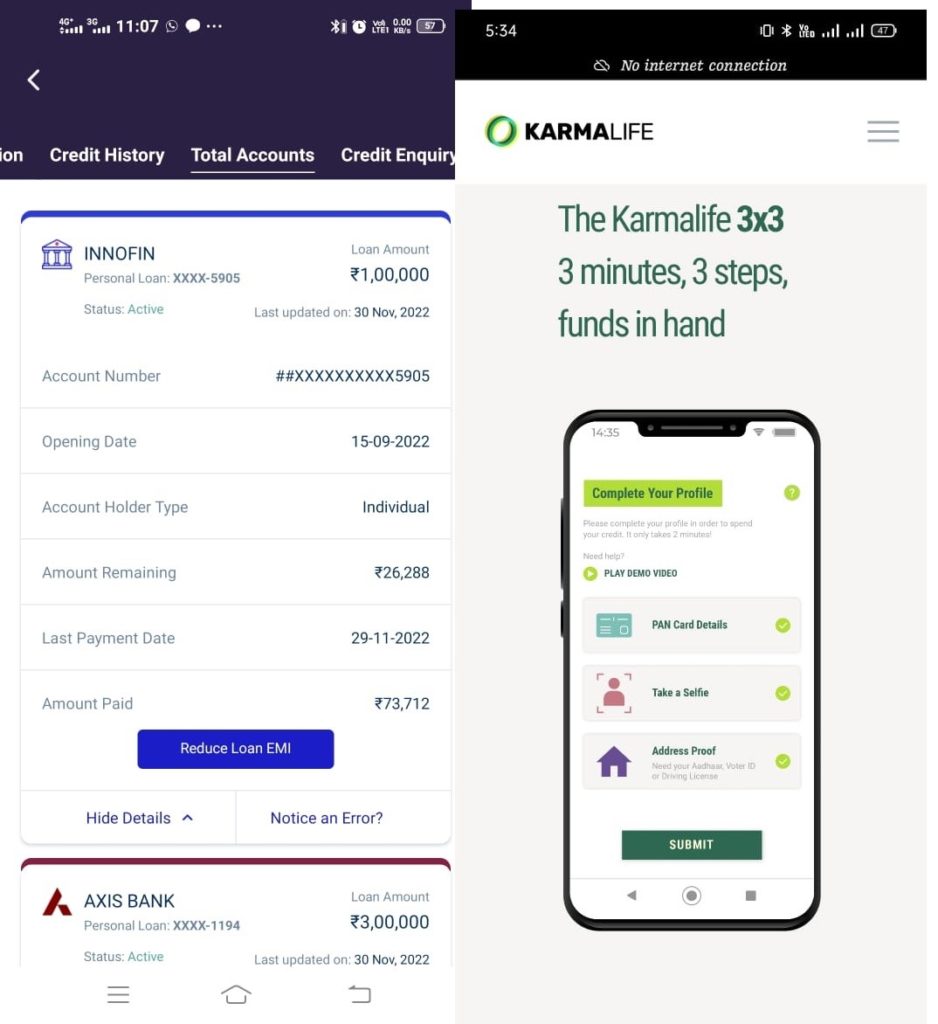

- CABT paid the salary of these employees through an app called KarmaLife (karmalife.ai).

- The app or website required all of them to upload their personal information and documents on it for profile activation.

- The loans are showing to be sanctioned by a company named Innofin.

- InnoFin is one of the partners of Karmalife, where the employees were made to open their accounts.

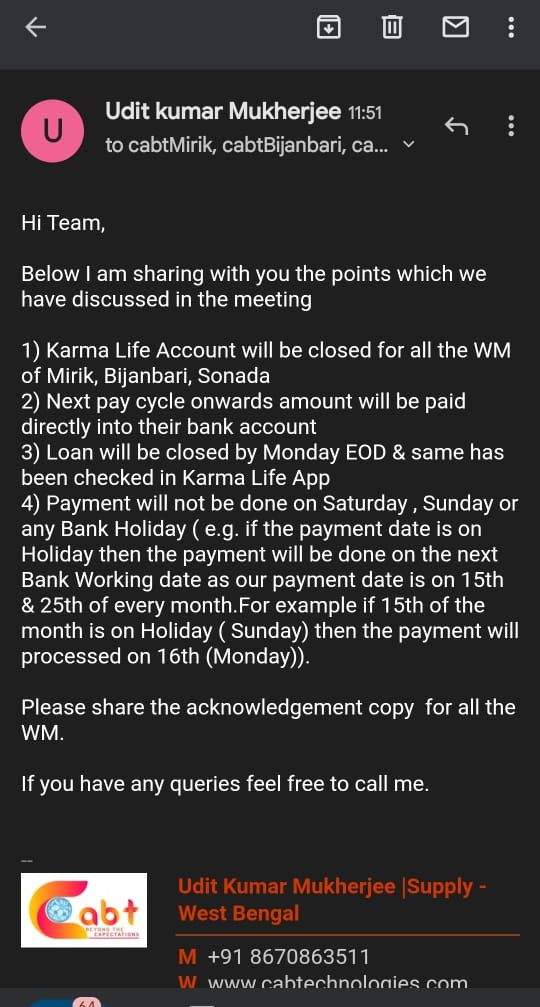

On discovering the situation, the victims tried to communicate the same to the company employing them (CABT), to which they were assured that it was nothing but a technical glitch and that it would be fixed in few days’ time. The victims, however, were highly suspicious that it wasn’t a technical glitch and that their data and documents were leaked through the KarmaLife app, and later used to draw the said amount of loans by the culprits. It is important to note that the suspicion arises by the fact that the problem was only visible for all the delivery executives who used KarmaLife to receive the salary, whereas their colleagues doing the office work, who would receive their salaries in their accounts, did not have to face the same.

The victims together shut down the operations of Ekart in Mirik immediately. Following the graveness of the situation, Suman Malik, the area manager of CABT visited Mirik and met the victims and assured them that the issue will be resolved within the next few days.

Nonetheless the victims decided to report the case with the police and on the same day i.e. 7th January and a formal complaint was filed by them at Mirik Police Station. Later the victims also filed a complaint with the SDO, Mirik on the 10th of January.

Acting on the complaint, the area manager of Ekart, Sumon Roy was taken into custody immediately, however he was released on bail. The lawyers of the company also met the victims on the 9th of January and assured them that their issue will be resolved in a maximum of 4 days from then.

While corresponding with TheDC, the Mirik Police expressed that they have taken the case seriously from the very first day and that the investigation in continuing. The Officer-in-Charge (OC) maintained that all the necessary steps had already been taken, from filing of the FIR to forwarding the case to the court. He further said that the case was now being investigated by the Cyber Cell, and that even though cases of such nature need time to be resolved, they would do their best to get it resolved at the soonest possible time.

We also tried to contact KarmaLife for their comments, but till date we haven’t receive any response from them.

Modus Oprendi

We tried to understand the method of association of the delivery agents with the company going by the details provided by one of the victims named Subham:

Subham had got information about the job from one of his friends, who was already employed in the company as a delivery executive himself. After agreeing to take on the job, he received a telephonic call from the HR, who confirmed his employment. He had to submit copies of his Driver’s Licence, Aadhar Card, his phone number and personal details along with a photograph as a part of the official formality. He, however, didn’t receive any contract or document as a proof of his employment, except for an employee id.

He was told by the office that it was mandatory for him to open an account in KarmaLife app to receive his salary, as so were all the delivery agents. The instruction came down from the company’s management through the team leaders and the office operators.

According to him, he had to provide his own contact number to register an account at KarmaLife. Also, he holds that he had never shared any OTP with anyone, neither did he receive any message or email about any loan getting sanctioned on his name. However, loan had been taken out in his name.

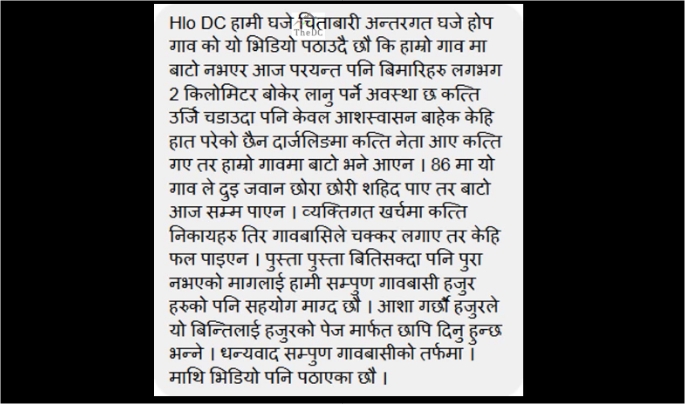

After the case coming to light, several other Delivery Agents employed by CABT from Bijanbari and Sonada have also come up with the same complaint.

When we contacted the Area Manager of CABT, he did confirm that it was CABT that mandated the employees to register to KarmaLife App, but declined to provide any further details citing that the same could be taken from the company’s lawyers, who we failed to connect to despite our attempts.

Questions Galore

Now, there are few important questions that come up here:

- Why would CABT mandate its employees to have an account to receive their salaries in an app primarily providing loan services?

- How would KarmaLife or InnoFin Sanction Loans of such huge amount without KYC verification of the people concerned?

- How would loans of such amount be sanctioned in the name of such young people who did not have an extravagant income to match the amount of loan?

- Is it a case of identity theft and fraud, or also a case of large scale money laundering, as most of these amounts were getting paid as well in a rather very quick period of time?

- Is Mirik just a tip of the iceberg, with such cases possibly spread all over the district, state or even the country?

As of today, the case is yet to be heard in the court. The delivery boys have found that their loans were cleared.

However, what no one seems to know is, who took out the loan, and for what purpose?

Being based out of Darjeeling, we have limited reach in financial journalism circles. However, if anyone with good enough reach wants to continue investigating this case, we would be more than happy to share the details we have unravelled so far. On our part we will emailed the details we have uncovered so far to the Reserve Bank of India, and the Ministry of Finance.

Be the first to comment on "MIRIK “JAMTARA”: How eKart Vendor CABT Took Out Loan Using their Employees Personal Data"